Clarifying the Commercial Real Estate Closing Numbers

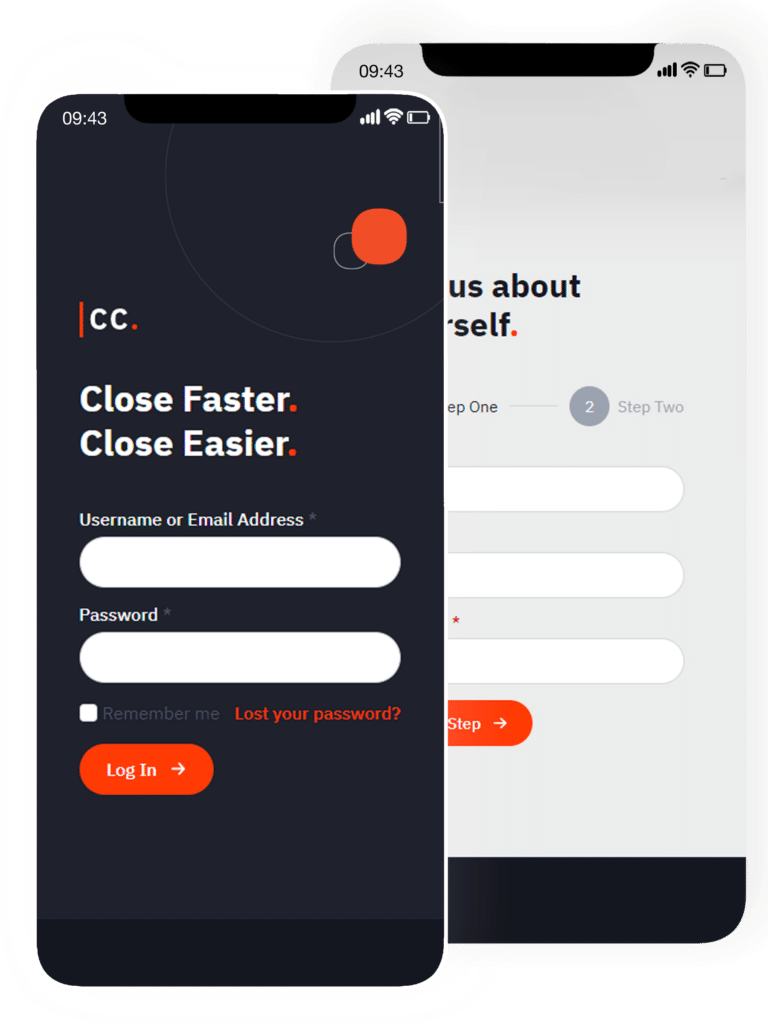

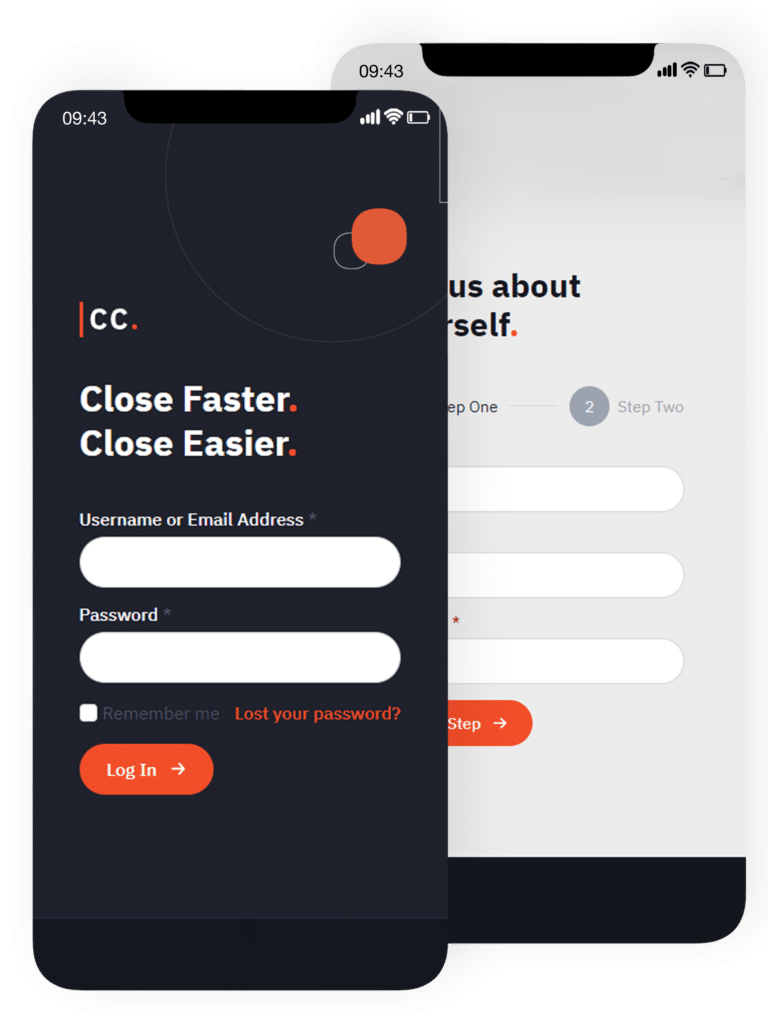

Why is the calculation of the closing numbers in a commercial real estate transaction - the driving force behind every deal - done at the last minute? Know your numbers, early and easily. Stop wasting time and money by getting ahead of your largest transactions.